On June 13, 2019; Finance Minister AHM Mustafa Kamal announced Tk 523,190 crore budget for the financial year of 2019-20. The new budget is 18.1 percent of GDP.

Prime Minister Sheikh Hasina exhibited portions of the national budget as Finance Minister AHM Mustafa Kamal fell wiped out part of the way through his discourse.

The new budget Tk 377,810 crore as income in the fiscal year.

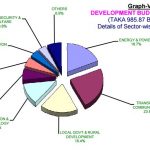

Bangladesh Budget 2019-20 summary

All out Bangladesh Budget 2019-20: 523190 crore.

Improvement Budget for 2019-2020: 2,02,721 crore.

Non Development Budget: 310262 taka.

Deficiency: 145380 crore (5% of GDP)

Bank Borrowing: 47,364 crore.

Outside Source Borrow: 63,848 crore

NonBank Borrowing: 30,000 crore.

All out Revenue: Tk. 377810 crore.

NBR Earning: Tk. 325600 : 37.8%VAT, 36% personal Tax. Import obligation 27.2%.

Non NBR Earning: tk. 52210 crore.

Security for 16 lakh more

Some 15.45 lakh individuals would be added to the administration’s center social security net projects in monetary year 2019-20 taking the aggregate to 1.13 crore.

Presently, 97.13 lakh individuals get recompenses under 17 social security and a few other social safety net projects of the legislature.

Despite the fact that Bangladesh gained noteworthy ground by getting 1.6 crore individuals out of neediness throughout the most recent decade, 12.9 percent of the populace are as yet ultra-poor and live on under $1.90 every day, the worldwide destitution line, as indicated by the Bangladesh Bureau of Statistics.

The administration has likewise wanted to step by step bring all money moves under the legislature to people (G2P) framework with the goal that the beneficiaries don’t need to pay some dues to get the cash.

Under the G2P framework, installments are prepared from the administration exchequer to the recipient’s bank or versatile financial balance.

The government proposed allotment of Tk 74,367 crore for all its safety net projects, up by Tk 9,963 crore from a year ago.

Products price will go up after budget 2019-20 announcement.

Costs UP: Cosmetics, mobile phone services, ceramics, cigarettes, helicopter renting, plastic products, aluminium products, cooking oils, medicines, marriage media centres, ice cream, vehicle registration, route permit for vehicles, fitness certificate for vehicles, astrology, drama, movie, handmade confectioneries, milk, sugar, body spray, ovens, broilers, grillers and smart phones.

Products price will go down after budget 2019-20 announcement.

Costs DOWN: Lightening arresters, firefighting equipment, building bricks, cancer-related medicines, coco substrate and coco pellet used in home gardening, gold and electric fan.

Cell phone calls may get costlier

Cell phone administrations are probably going to wind up costlier from today because of expanded assessments.

The National Board of Revenue sent an administrative request to the portable conveys to build the strengthening obligation (SD) to 10 percent from 5.

The request came not long after the finance minister’s proposition in the budget.

The assessment climb would influence the clients of around 16 crore dynamic SIMs.

Aside from 10 percent SD, endorsers presently pay 15 percent VAT and 1 percent extra charge available to come back to work and SMS charges. For information utilization, the VAT is 7.5 percent.

For calls and messages, an endorser would probably use about Tk 78.27 for each Tk 100 refill under the new expense structure. The rest would go to the administration exchequer.

Duties on new SIM and SIM substitution are additionally expanded to Tk 200 from Tk 100.

Be that as it may, the expense of broadband web would stay unaltered.

Smoking gets costlier

The legislature has essentially raised the costs of tobacco items to control utilization.

In the proposed budget, the cost of a 10-stick pack of premium cigarette was raised to Tk 123 from Tk 105.

On the off chance that the budget gets affirmed, the retail cost of a 20-stick premium pack will be about Tk 246 from Tk 210.

In the high fragment, a 10-stick pack is set at Tk 93, up Tk 18 from the past cost.

7.5% VAT on Digital Business

When the legislature ought to empower virtual organizations, Finance Minister AHM Mustafa Kamal has proposed 7.5 percent esteem included duty them in his budget for financial 2019-20, making their administrations dearer.

The virtual organizations were anticipating attractive impetuses from the legislature and rather got this slap on the wrist.

Ride-hailing organizations are making good on 5 percent regulatory obligation on their profit, however the administration proposed forcing an extra VAT on their administrations from July 1.

Over VAT, both computerized organizations and buyers should spend more for utilizing web as the legislature has officially multiplied the beneficial obligation for versatile web use to 10 percent.

Bangladesh Budget 2019-20 Reactions

BNP terms budget ‘profoundly yearning’s

Manin political opposition BNP named the budget for monetary 2019-20 exceedingly yearning.

“The fund minister has set himself on the race of setting enormous budgets,” BNP Secretary General Mirza Fakhrul Islam Alamgir said in their post-budget question and answer session.

Fakhrul stated, individuals have no enthusiasm over the size of budget as the portion in each budget is decreased toward the finish of consistently. “Individuals won’t acknowledge this budget.”

TIB pummels absolution for dark cash

Straightforwardness International Bangladesh (TIB) firmly denounced the proposed absolution for dark cash in the budget for financial 2019-20 and named it “illegal, improper and unfair”.

In an announcement, the Berlin-based debasement guard dog said that keeping extent of brightening dark cash was “defilement inviting”.

Iftekharuzzaman, official chief of TIB, stated, “The proposed absolution for dark cash in the national budget is against article 20(2) of the constitution and opposing to Prime Minister Sheik Hasina’s zero-resistance strategy against defilement.”