Bangladesh Government Expenditure for fiscal year 2015-16 – Public Services: 56696 crore taka, Local Govt and Rural Development: 20996 crore taka, Defense Services: 18383 crore taka, Public Order and Safety: 13630 crore, Education and Technology: 34370 crore, Health: 12695 cr, Social Security and Welfare: 16725 cr, Housing: 2918 cr

Development Expenditure for 2015 – 2016, Recreation, culture and religious affairs: 2283 crore, Fuel and Energy: 18540 crore, Agriculture : Tk 13,675 crore, Industrial and Economic Services: 2755 crore, Transport and Communication: 28700/-, Interest : 35109 cr taka

Bangladesh budget 2015-16 Resource coming from, Tax Revenue (NBR) : 59.8%, Foreign Grants :2%, Foreign Loan: 8.2%, Domestic Financing : 19.1 %, Non-Tax Revenue : 8.9%, Tax Revenue : Non NBR : 2.0%

Revenue Receipts in Budget 2015-16 of Bangladesh

Tax Revenue (NBR) : 176370 crore taka

Non-Tax Revenue : 182244 crore taka

Tax Revenue : Non NBR : 26199 crore taka

Non-Development and Development Expenditure Budget 2015-16 of Bangladesh ( BD budget 2015-16 )

excluding loans & advances, food account operation, domestic & foreign debt and structural adjustment expenditure

Budget 2015-16 for Office of the President : 16 cr taka

Budget 2015-16 for Parliament : 204 cr

Budget 2015-16 for Prime Ministers Office : 801 crore taka

Budget 2015-16 for Cabinet Division : 50 cr

Election Commission : 1486 cr

Ministry of Public Administration : 1448 cr

Public Service Commission : 34 cr

Finance Division : 47983 cr

Internal Resources Division (IRD) : 1800 cr

Bank and Financial Institution Division : 204 Crore Taka

Budget 2015-16 for Economic Relations Division : 151 Cr Taka

Planning Division/2 : 1085 Crore Taka

Implementation, Monitoring and Evaluation Division : 139 cr

Statistics and Informatics Division : 393 Crore Taka

Ministry of Foreign Affairs : 902 Crore Taka

Local Government and Rural Development : 18867 Crore Taka

Rural Development and Co-operatives Division : 1350 cr

Budget 2015-16 for Ministry of Chittagong Hill Tracts Affairs of Bangladesh : 779 Crore Taka

Ministry of Defense – Defense Services : 18072 Crore Taka

Ministry of Defense – Others Services : 290 Crore Taka

Armed Forces Division : 21 cr

Law and Justice Division : 1042 Crore Taka

Supreme Court : 112 Crore Taka

Ministry of Home Affairs : 12392 Crore Taka

Anti Corruption Commission : 63 Crore Taka

Legislative and Parliamentary Affairs Division : 21 crore

Ministry of Primary and Mass Education : 14502 crore taka

Ministry of Education – Education Division : 17103 cr

Ministry of Science and Technology : 1551 cr

Budget 2015-16 for Ministry of Information and Communication Technology : 1214 cr

Budget 2015-16 for Ministry of Health and Family Welfare : 12695 Crore Taka

Ministry of Social Welfare : 3256 Crore Taka

Ministry of Women and Children’s’ Affairs : 1678 Crore Taka

Ministry of Liberation Affairs : 2679 Crore Taka

Food Division : 1672 Crore Taka

Disaster Management and Relief Division : 7440 crore Taka

Ministry of Housing and Public Works : 2918 Crore Taka

Ministry of Information : 656 Crore Taka

Ministry of Cultural Affairs : 365 Crore Taka

Ministry of Religious Affairs : 428 Crore Taka

Ministry of Youth and Sports : 834 cr

Energy and Mineral Resources Division : 2037 cr

Power Division : 16503 Crore Taka

Ministry of Agriculture/3 : 12699 Crore Taka

Ministry of Fishery and Animal Resources : 1489 Crore Taka

Ministry of Environment and Forest : 1019 Crore Taka

Ministry of Land : 886 Crore Taka

Ministry of Water Resources : 3886 Crore Taka

Ministry of Industries : 1373 Crore Taka

Ministry of Textiles and Jute : 284 Crore Taka

Ministry of Commerce : 359 Crore Taka

Ministry of Labour and Employment : 302 Crore Taka

Ministry of Expatriates’ Welfare and Overseas Employment : 437 cr

Roads transport and highway Division : 7911 Crore Taka

Railway Ministry : 7717 Crore Taka

Ministry of Shipping : 1376 Crore Taka

Ministry of Civil Aviation and Tourism : 372 Crore Taka

Ministry of Post and Telecommunications : 2371 Crore Taka

Bridges Division : 8953 Crore Taka

Interest Domestic : 33996 Crore Taka

Interest Foreign : 1713 Crore Taka

Income tax in budget 2015-16 Bangladesh

AMA Muhith has proposed for expanding the roof of expense free pay to Tk 2.50 lakh from Tk 2.20 lakh.

While setting his financial plan discourse before the parliament, Muhith proposed expanding expense exclusion limit for ladies and senior nationals matured more than 65 years from Tk 2.75 lakh to Tk 3.00 lakh.

In perspective of the obligation of both the general public and the state for physically tested individuals, the fund serve likewise proposed to build charge exclusion limit for them from Tk 3.50 lakh to Tk 3.75 lakh.

propose to expand charge exclusion edge for gazetted war-injured opportunity contenders from Tk 4.00 lakh to Tk 4.25 lakh.

Obligation overhauling may increment by Tk 3,000 crore to Tk 4,000 crore in budget 2015-16 from the present year’s Tk 31,034 crore.

To meet the consumption, 27.78 percent income development has been assessed notwithstanding the current monetary year’s poor execution in income gathering.

Around 85 percent of the aggregate income originates from the National Board of Revenue, and they have been tasked with boosting their accumulation by 31 percent over the present year.

To encourage the expanded accumulations, the extent of quality included assessment will be broadened and some imaginative measures forced, fund division authorities said.

On the salary expense side, other than expanding the quantity of citizens, activities will be taken to gather more duties through change measures.

Another huge wellspring of stores for the legislature is non-charge income, whose objective has been expanded around 14 percent year-on-year.

The financial backing shortage has been kept inside of five percent of the GDP, which is in keeping with global practices.

A major segment of the shortage will be met through high-cost inner acquiring, which is around Tk 55,880 crore. Of the sum, Tk 38,380 crore will be obtained from the managing an account framework and the staying from investment funds instruments.

Analysis Budget 2014 – 2015 in Bangladesh

as far as total government use – reflects around a 23 for each penny ascend over that of the changed spending plan for the active financial (2014-15); it is additionally around 56.8% higher than the real figure for the past one – FY 2013-14. Whether financing the proposed general open use in the approaching monetary in a nothing new manner is achievable or not is a correlated issue. It justifies a target and impartial investigation and examination. Be that as it may, there were sufficient evidences, before its spreading out, about its imaginable size at the level or even somewhat more than what has now been declared. That is vitally the motivation behind why its proposed size has not come as a shock.

The evaluated size of the yearly consumption of the administration through the national spending plan for FY 2015-16 will be around 17.2% of the nation’s (GDP). From a more extensive viewpoint, the GDP-government consumption proportion in Bangladesh is still lower than a number of its comparator and different nations. This must, be that as it may, be deciphered mindfully. The results and nature of open use are matters of far more prominent outcome here. How far the increments in total open consumption throughout the years have added to proficiency and nature of administrations or works that are rendered or done by Government, is the unsettled issue for thought. This remains constant for both current (non-advancement) and improvement consumptions of Government in Bangladesh. The non-improvement open consumption incorporates the wages and compensations bill and all other repeating sort spending. Under the proposed spending plan for financial 2015-16, such non-advancement consumption will represent 11.5% of the nation’s GDP contrasted with 10.7% (of the GDP) in the active one. In supreme terms, government’s non-advancement spending will ascend to Taka 1.98 trillion in FY 2015-16 from Taka 1.61 trillion under the changed spending plan for the active financial. Update of pay scale and incidental advantages for open representatives and additionally installments of improved benefits and tips for the resigned open hirelings will represent a significant piece of this proposed extra non-advancement consumption.

The measure of government use in respect to GDP separated, what has nowadays come into a sharp center is the quality that the customary residents or citizens receive consequently. Also, all concerned do comprehend what people in general feeling in the nation, on genuine or saw grounds, is about this, passing by the quality for-cash standard. For non-advancement or current open use to end up financially savvy, hard endeavors for a quantum jump openly benefit conveyance framework accept discriminating significance. Every single progressive government never been discovered needing in conceding this. Be that as it may, they have scarcely moved energetically to help enhance things.

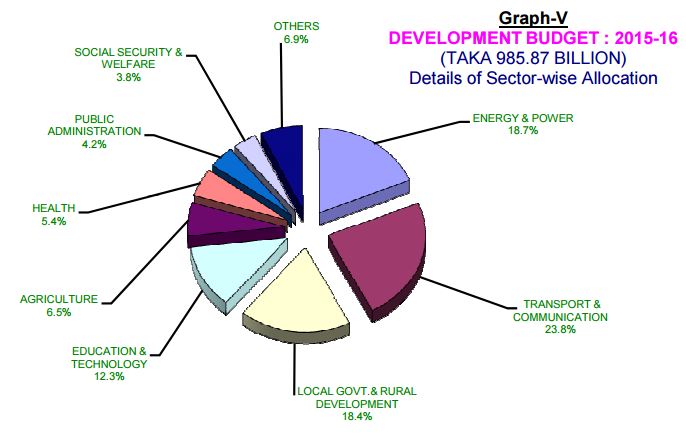

On the advancement side, the proposed spending plan for monetary 2015-16 has dispensed Taka 970 billion for financing the Annual Development Program (ADP). This denote an increment of Taka 22 billion over the reexamined ADP of Taka 750 billion for the active financial. Then again, every single accessible marker, starting now, would have a tendency to propose that the real usage of the stores even under the reexamined ADP for FY 2014-15 would witness a remarkable deficiency. This will be clearly thus, as far as coordinating physical advance about usage of advancement undertakings included in it. Nonetheless, this has not been an unordinary picture throughout the years in a continuous grouping.

The advancement consumption under the proposed spending plan for financial 2015-16, or more the extra measure of cash that the self-governing bodies will spend on some of their particular tasks under self-financing plan, has been proposed to be raised to 11.6 for every penny of the nation’s GDP. On the off chance that that can be acknowledged toward the end of the following financial, it will be a ‘quantum jump’ in ADP execution limit in a solitary year. This is on account of the offer of advancement use, bringing with the overhauled ADP and self-financed tasks of self-governing bodies into thought, remains at 5.1% of GDP in the active monetary. Starting here of perspective, the anticipated level of improvement use in the imminent financial is clearly very yearning unless some “marvel” happens about task usage execution.

In his financial plan discourse, the Finance Minister has been straight to the point enough to concede the issues that have been looming the advancement about execution of ADP activities. Such issues are surely understood for long and have been delaying, without being tended to legitimately. This has been taking an overwhelming toll on the economy’s general execution. Mr. Muhith has, once more, indicated taking some genius dynamic strides to unknot the tangles including those identifying with the tremendously advertised about open private association (PPP) extends in the pending financial. This is an overwhelming test before the legislature to reclaim its guarantees on this specific front. This is especially all the more thus, in light of the fact that the prospective monetary will be the starting year of the new Seventh Five Year Plan period. The score-card on the Sixth Five Year Plan period that ends on June 30, 2015, is not appetizing on a few numbers, for a mixed bag of elements. In his financial plan discourse, the Finance Minister has said various such missing connections in the middle of execution and projection.

Whatever degree the in advance of said ‘quantum jump’ in spending plan usage limit is practical or conceivable under the nation’s given circumstance is absolutely easily proven wrong. This is all the more so without any noticeable advancement saw so far in regions of hard and profound situated institutional and other basic changes. The administration must exhibit its ‘solid political will’ in completing such changes to help fortify administration as a rule and monetary administration, specifically. It is presently generally moderately better put to be ace dynamic about it, not being hamstrung, at any rate for the quick future by political misfortunes. The full scale financial basics are additionally agreeable, measured by the variables that demonstrate their relative qualities or shortcomings. This ought to, along these lines, give it the chances to activities that are expected to move the economy on a consistent and quickened development way with its advantages coming to the individuals at the grassroots. The current worldwide monetary circumstance, especially that about oil and item costs, is another in addition to element here. The financial backing discourse of the Finance Minister observes every one of these elements. Its semantics, talk, clichés and redundant verbiage should not make clamor just. Maybe, the time it now, time for the administration for activities.

Having noticed this, it must be expressed that the proposed national spending plan for financial 2015-16 faces its most difficult undertaking in satisfying the income gathering target. The National Board of Revenue (NBR) has been given an objective of acknowledging Taka 1.76 trillion as duties for FY 2015-16 under the proposed spending plan. Such an objective, in the background of a setback of Taka 190 billion under the amended spending plan for monetary 2014-15 in connection to the first one for the year, will include a Herculean errand in regions of extension of duty system specifically. Its execution will depend not just on its ventured up drive for income accumulation additionally on the force of general financial exercises, for the most part in the private segment.

The proposed spending plan for the imminent financial tasks the economy’s development rate at 7.0% and sets the swelling focus at 6.2%. Development will discriminatingly depend on the level of interest in the private segment. Keeping up the expansion target will call for suitable, successful and coordinated reflex activities by the monetary administration powers and the fiscal guard dog. Any dissonant pattern about financial advancements and fiscal administration strategies will make it hard to keep the value level inside of the anticipated level. Last yet not the minimum, boosting private division speculation exercises that have stayed stagnant for a significant time of time will not the slightest bit be affected by anybody’s wish-or. There is no push-catch plan. For this to happen, the variables that have hindered such speculation will should be tended to, precisely and genuinely, on a need premise. That is likewise discriminating to empower the Bangladesh economy to leave, what the Finance Minister said, ‘6.0 pc development trap’ and to proceed onward to a higher development direction