Understanding ROI: A Comprehensive Guide to Return on Investment

Return on Investment (ROI) is a critical metric used by businesses, investors, and analysts to assess the profitability and efficiency of an investment. Whether you’re evaluating a marketing campaign, a business venture, or the performance of stocks, understanding ROI is key to making informed financial decisions. This article will delve deep into what ROI is, how to calculate it, and why it’s such an essential concept in both business and personal finance.

What is ROI?

ROI (Return on Investment) is a performance measure used to evaluate the efficiency of an investment or compare the efficiency of several different investments. It’s a simple yet effective formula that measures the return relative to the investment’s cost. It allows businesses and investors to gauge whether the returns generated from an investment justify the amount spent or committed.

In its simplest form, ROI is expressed as a percentage. By comparing the profits or benefits from an investment to its cost, ROI helps determine the profitability or efficiency of that investment.

Explaining Return on Investment

Return on Investment refers to the financial gain or loss generated from an investment, relative to its initial cost. Investors use ROI to assess how well an investment has performed, and businesses use it to evaluate the effectiveness of marketing campaigns, product launches, and other initiatives.

When someone refers to a return on investment, they are looking for a clear, quantifiable result showing how well their money was put to work. For example, a business may invest in a new marketing strategy and want to calculate the ROI return on investment to determine whether it was worth the cost.

The key here is that ROI quantifies the relationship between profit and investment. In business, ROI is often used in decision-making, guiding where to allocate resources and which opportunities to pursue based on their expected returns.

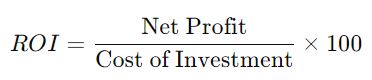

ROI Formula: How to Calculate Return on Investment

To calculate ROI effectively, it’s important to understand the ROI formula. The most basic form of the ROI formula is:

Where:

-

Net Profit is the total revenue from the investment minus the cost of the investment.

-

Cost of Investment is the initial amount spent on the investment.

Understanding the Return on Investment Formula

The return on investment formula is designed to show you a percentage that helps you determine whether your investment is worthwhile. If the ROI is positive, it means the investment is generating more profit than the cost involved. A negative ROI indicates a loss, suggesting that the investment may not be efficient or profitable.

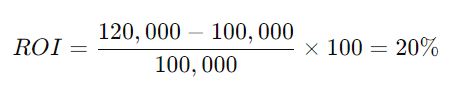

For example, if a company spends $100,000 on a marketing campaign and generates $120,000 in revenue from that campaign, the return on investment ROI formula will look like this:

This means that the marketing campaign generated a 20% return on investment, making it a profitable venture.

The Importance of ROI in Investment Decisions

Every investor and business manager should have a clear understanding of ROI in investment to make informed decisions. The primary reason for tracking ROI is to assess the financial return from any investment activity. Whether you’re an individual investing in stocks, real estate, or a business making decisions about marketing, production, or other capital expenditures, ROI is an invaluable tool to determine success.

What Does a Positive ROI Indicate?

A positive ROI return on investment indicates that the investment has been successful. This means that the revenue generated from the investment is higher than the initial cost, which can be seen as a profitable venture. In contrast, a negative ROI would signify that the investment didn’t generate enough revenue to cover the initial costs, leading to a loss.

Assessing Different Types of ROI Investment

Different types of ROI investment include various financial sectors, such as real estate, stock market, and business ventures. Here are some key areas where ROI is commonly applied:

-

Real Estate: In real estate, ROI is used to assess how well an investment property is performing. Investors calculate ROI based on rental income and property value appreciation.

-

Stocks: In the stock market, investors use ROI to determine how much return they’ve earned relative to their initial investment in shares.

-

Business Ventures: Entrepreneurs often use ROI to decide whether to invest in a new business or a product line. Positive ROI means the business initiative is worth pursuing, while negative ROI might require reevaluation or adjustment.

Why is ROI Important for Businesses?

For businesses, calculating ROI is crucial for understanding how investments contribute to the bottom line. Businesses use ROI calculations to determine which projects, campaigns, or products yield the best returns. Whether assessing the profitability of a marketing campaign or the potential success of launching a new product, ROI helps prioritize efforts and allocate resources efficiently.

Calculating ROI for Different Business Activities

Businesses invest in various activities, and calculating ROI helps to gauge the effectiveness of each one. Here’s how ROI can be calculated for different business activities:

1. Marketing Campaigns

One of the most common uses of ROI is in marketing. For example, if a business runs an email marketing campaign, the company will need to calculate the return over investment to determine if the campaign was effective.

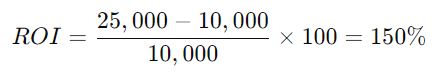

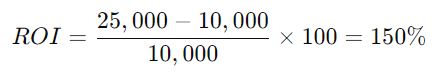

Suppose the campaign cost $10,000, and it generated $25,000 in sales. The ROI would be calculated as follows:

This indicates that for every dollar spent, the business earned $1.50, which is a strong return on investment.

2. Product Development

When a company invests in developing a new product, the return and investment is calculated by comparing the cost of product development to the revenue generated by the product once it’s launched.

For example, if developing a new product costs $200,000 and it generates $400,000 in sales, the ROI would be:

This shows that the company doubled its investment, making the product development worthwhile.

3. Employee Training Programs

Calculating ROI can also be useful for employee training programs. For instance, if a company spends $50,000 on training programs and sees an increase in productivity worth $100,000, the ROI would be:

This indicates that the investment in training generated significant returns.

What is ROI in Investment?

ROI in investment is a measure of how much return an investor earns from an investment relative to the initial cost of the investment. For example, in the stock market, ROI can help investors assess the performance of their investments, and in real estate, it can help investors determine the profitability of property investments. The key factor in ROI is whether the return justifies the risk and cost of the investment.

ROI: A Return on Investment for Different Asset Classes

ROI is used across various asset classes, including:

-

Equities (Stocks): ROI in equities refers to the percentage return generated from investing in stocks, including dividends and capital appreciation.

-

Real Estate: Real estate investors use ROI to evaluate the profitability of a property, considering factors such as rental income and property value growth.

-

Bonds and Fixed Income: Investors in bonds use ROI to measure the return generated from interest payments and capital gains from bond sales.

By calculating return on investment ROI formula, investors can compare the potential returns from different asset classes and determine the best options for their investment portfolio.

A Return on Investment: Key Insights

Investing is all about achieving a return on investment. This could be in the form of capital appreciation, income generation, or cost savings. Businesses, individuals, and organizations calculate ROI to ensure they are making efficient investments that bring the highest returns. Understanding how to calculate ROI is a fundamental skill for anyone looking to maximize their financial outcomes.

Whether you’re an individual investor evaluating your stock portfolio or a business owner deciding between different marketing strategies, calculating and understanding ROI is essential. It allows you to evaluate not just the financial outcomes of your investments, but also the risks involved in them.

Key Takeaways from Understanding ROI

-

ROI is a critical tool in assessing the profitability of an investment.

-

It allows businesses to make data-driven decisions about where to allocate resources.

-

Return on investment ROI formula provides a simple yet powerful way to quantify profits.

-

Positive ROI indicates a profitable investment, while negative ROI signals potential losses.

-

Knowing how to ROI calculate is essential for investors and businesses alike.

In conclusion, return on investment is not just a simple financial metric; it is a crucial aspect of assessing investments across different sectors. Whether you’re dealing with ROI in investment, business ventures, or personal finances, understanding ROI is essential for making smart, strategic decisions. As an investor or business manager, always keep in mind that return and investment are closely linked, and the ultimate goal is to maximize that return through careful analysis and informed decisions.